Your Realtor for Greater Chicago and Northwest Indiana

Smart Homebuying with Maximum Value

Expert guidance | Transparent Pricing | Efficient Communication

It's tough to know who's truly on your side ...

Tired of

Paying high commissions with little value in return?

Feeling pressured to sign before you’re ready?

Agents who put their commission ahead of your goals?

Vague answers or poor market knowledge?

Waiting days for a response to your questions?

With all the flashy marketing out there, how do you know who genuinely has your back?

Realex Realty was built for you.

How we make it happen:

- Great at finding homes online? Save more with us.

- Innovative commission options and rebates to maximize your savings.

- Transparent, upfront pricing with no hidden fees.

- Competitive rates that strengthen your offer.

- Zero pressure or sales gimmicks—just genuine support.

- Honest, expert advice to help you avoid costly mistakes.

- Experienced professionals guiding you every step of the way.

- In-depth research to uncover what marketing photos don’t show.

- Whether first-time buyer or seasoned investor, we’ve got you covered.

- E-signing for a fast, hassle-free transaction.

- Licensed to sell homes in Illinois & Northwest Indiana.

To Help You Decide

We prepared a Pros and Cons list so you can see if we are a good fit

Benefits

Transparent pricing upfront

From our first conversation, we provide a clear commission quote for your home purchase. No hidden fees, no surprises—just full transparency.

Customized pricing structure to help you win

We tailor our commission structure to fit your specific transaction. In competitive situations, it can be the deciding factor between a successful closing or a dead deal.

Dedicated agent looking out for your best interest

Real estate transactions involve multiple parties, laws, and regulations—many of which you may not be familiar with. Having an experienced professional by your side ensures your best interests are always protected.

Technology-driven efficiency

No more paper shuffling. We leverage the latest document-sharing and e-signature technology to streamline the process and make your life easier.

Need us? We’re just a message away. We can be reached via e-mail, text, phone, or online chat.

Expert guidance every step of the way

We do far more than just show properties. From contracts and inspections to loan underwriting and closing prep (though we’re not lawyers), we offer expert advice and consultation to help you navigate the entire process with confidence.

No sales pitches, just honest advice

We provide clear, objective assessments and answer all your questions—without pressure or gimmicks. You make the decisions; we simply guide you.

Simplifying the complex

We believe in clarity, not confusion. No jargon, no hidden procedures—just straightforward guidance to help you understand every step of the home-buying process. You deserve to be informed.

Bigger savings on higher-priced homes

For homes over $500K, our pricing structure allows for significant buyer savings—either through lower commission rates or high rebates at closing. The higher the price, the greater the savings.

Considerations

You need to be comfortable with technology

At the very least, you’ll need a smartphone or computer. For our program to work efficiently, you should be able to search for homes online and visit properties or neighborhoods to see what suits you. This is one of the key ways we cut costs and pass those savings directly on to you.

We might limit the number of free showings

In practice, we’ve seen that unlimited showings always lead to burnout and decision fatigue. Capped showings help keep the process focused and efficient. It also helps us keep the cost low, where we can pass the savings on to you.

We’ll provide a personalized quote based on your individual needs and circumstances. But if you truly need more showings, we’ll discuss with you and adjust our plan accordingly.

Conduct Your Own Market Research

Over the years, we’ve found that realtor involvement in the property search process can be counterproductive and intrusive. With so much information available online, buyers can easily find properties themselves. By cutting out this step, we can offer you significant savings. For more details, check our FAQ section.

Higher-priced homes offer bigger savings

We’re happy to assist all buyers, but due to the costs on our end, our savings are more substantial for homes over $500K.

Case Studies

We negotiated over 15% off the list price for Buyer A, plus a substantial rebate, Buyer A saved tens of thousands of dollars.

Buyer B was ready to overpay to secure a home, but with our strategic bidding advice, saved $20,000.

Buyer C faced a multiple-offer situation and was willing to pay over $10,000 above list price. We helped secure the home with just a few thousands more.

Buyer D’s lender imposed tough demands mid-process; we researched solutions, guided the client, and ensured a successful closing.

Numerous buyers received high rebates and negotiated discounts, saving thousands to tens of thousands of dollars.

Our priority is protecting clients’ interests. In an extreme case, we halted a deal at the last moment on the closing table, safeguarding hundreds of thousands of dollars for the client.

What Our Clients Say

After working with all sorts of agencies, dealers and services representatives, Edelyn from Realex Realty is the only one I felt is actually thinking and acting on MY best interest... her low-commission model helped me save a significant amount of money — without compromising service or results.

Will D.

I worked with Edelyn from Realex Realty to buy a house in Naperville, and she was fantastic from start to finish. She’s super knowledgeable, always quick to respond, and really made the whole process smooth and stress-free. Her fees are very fair, and she handled everything with care and professionalism...

Jessie H.

... Without Edelyn, there are so many things that could go wrong in our buying process. Edelyn understood our top priorities and crafted a compelling offer in a multiple-offer situation. Even after the house closing, Edelyn is still answering all our questions. Beyond her technical skills, Edelyn is simply a pleasure to work with: responsive (often replying within minutes), transparent, and more importantly caring...

Peter W.

...Even more impressive was how Edelyn dealt with the unpredictable (sometimes undesirable) twists and turns throughout the negotiation process, while maintaining a calm demeanor and prioritizing our interest at all times... also saved us thousands of dollars

Carol A.

Edelyn is very trustworthy, professional and attentive to her clients. She responds quickly to questions and works around the clock.

Xiaoyu C.

Edelyn from Realex Realty helped me sell my home in the northwestern suburb. She provided a thorough market analysis and guided us toward an effective marketing strategy that brought in multiple offers. We ended up selling for more than we expected! ...

Isaiah F.

As a first-time homebuyer, I had so many questions and concerns, but she always took the time to explain everything clearly and never made me feel rushed. She carefully walked me through each step of the process and always looked out for my best interests...

Alina L.

From the very beginning, she went above and beyond to make the entire process smooth, stress-free, and successful. Her professionalism, deep knowledge of the market, and genuine care for her clients truly set her apart. She was always available to answer my questions, explained every step clearly, and provided honest advice that I could trust. More than just a realtor, she was a true partner and advocate who always had my best interests at heart...

Sergio G.

Save our website to your email

So you can find us later when you are ready. We never spam.

FAQ

Check out the commonly asked questions, or Contact Us.

How much do you charge?

We use a tiered pricing structure — the higher the home price, the lower our commission rate. Since every homebuyers’ situation is unique, we provide customized quotes on a case-by-case basis.

Do you offer rebates to homebuyers?

Yes, we offer a flexible pricing structure, including rebates, to help you save money while negotiating for a home. When determining a net commission rate, we work with each homebuyer to develop a strategy that: 1. Helps you win the deal, 2. Maximizes your savings, and 3. Covers closing costs if needed.

I heard there were some major changes about realtor commission in 2024. So how does it work now?

Simply put, there were two major changes:

- Buyer agent commissions are no longer displayed on the MLS. Before July 18, 2024, home-search portals like Realtor.com and Redfin.com showed the exact commission rate offered by sellers. This feature has now been permanently removed.

- Buyers must negotiate agent commissions upfront. Before touring homes, you’ll need to determine the commission for your buyer’s agent and sign a buyer agency agreement.

How does this change impact ME as a homebuyer? Do I need to pay more?

No, you don’t have to pay more than before.

In fact, these changes give you more control and transparency in your homebuying process.

The old way: You probably didn’t know if or how much your agent gets paid. Some buyers really believed that their agent was “free”. Because for each home, your agent gets paid a pre-decided commission by the seller. You were never involved in the discussion.

The new way: You’ll discuss and agree on your agent’s commission at the first meaningful interaction, just like you would with any home contractor. The difference is, in the homebuying process, you can negotiate to have the sellers pay this fee for you (just as they did under the old way, but you have to ask for it ). Most sellers will agree to compensate the buyer’s agent because it boosts their chances to get their homes sold.

This added layer of negotiation gives you greater insights into costs and services, allowing you to compare agents just like you would when shopping for a mortgage lender.

How can you offer competitive commission rates for buying and selling homes?

Simple — we’re not tied to the outdated brokerage model that still dominates real estate. Traditional brokerages often charge the same high percentage regardless of the home’s price, even when the work doesn’t justify it. We think that’s unfair.

At Realex Realty, we do things differently:

- Tiered Commission Structure: The higher the price, the lower the rate. Why? Because selling a $1 million home doesn’t take five times the work of selling a $200,000 one — so why should you pay five times the commission?

- Efficiency Over Excess: We skip the fancy offices, overpriced marketing, and franchise fees. Instead, we invest in smart tech and streamlined systems — and pass those savings on to you.

- Modern Mindset: Buyers and sellers today are more informed than ever. Yet many brokerages still cling to old-school models. We respect your time, your intelligence, and your wallet — and we’ve built our business around that.

You’re not paying for tradition. You’re paying for results.

At Realex Realty, you get expert service — without the premium markup.

Is commission rebate from real estate agents taxable?

No.

The IRS ruled that realtor commission rebates are not taxable income. So don’t worry that the big check you received will cause you tax burden at year end. However, we always recommend talking to your accountant about the specific tax advice when filing.

Are rebates legal in real estate?

Yes.

Realtor rebates are legal in most states in the U.S. It is perfectly legal here in Illinois and Indiana.

How do I search for homes? Isn't it a realtor's job to find properties for me?

Frankly, we believe a realtor’s direct involvement in the home search can be counterproductive and even intrusive. Too often, buyers change their preferences mid-way—sometimes making a complete 180-degree turn—or their budget unexpectedly shifts. Relying on a realtor to find your home can lead to wasted time and frustration on both sides.

That’s why our process works best when buyers have already shortlisted a few potential properties and then come to us for showings. This approach significantly reduces emotional stress and saves time for everyone involved. By cutting out this step, we’re also able to lower costs and pass the savings on to you.

How to conduct your own market research?

Start by asking yourself: What do you want in a home? Do you prioritize a short commute, space for a growing family, access to top-rated schools, or investment potential? Once you have a clear idea of your priorities, research different neighborhoods.

As the saying goes, location is everything. Your choice of neighborhood will directly impact your future lifestyle. Once you have a general idea of the type of properties that interest you, attend open houses to experience them firsthand. Pay attention to details like street parking, neighbors, yard maintenance, the home’s age, potential odors, sun exposure, and room layouts. This process will help you refine your preferences and identify deal-breakers.

We recommend setting up search alerts on real estate websites like Realtor.com or Redfin.com so you’re notified immediately when new properties hit the market. If you prefer, we can also set up an MLS alert for you.

While we encourage independent market research, we’re not leaving you to navigate the process alone. We offer free consultations to assess your needs, provide recommendations, and discuss strategies. And of course, we’re always just a message or phone call away.

What other fees should I expect when buying a home (beside realtor fees)?

Buying a home involves many parties, and the costs can vary depending on whether you’re getting a mortgage. Here’s a breakdown of the common fees to consider when setting your budget.

Fees you’ll likely pay, regardless of a loan:

- Attorney fee

- Title settlement fee

- Recording fee

- Transfer tax

- Hazard insurance

- Inspection fee

Additional fees when taking out a mortgage:

- Loan point

- Rate lock fee

- Underwriting fee

- Credit check fee

- Appraisal fee

- Title insurance

- Flood zone search fee

- Documentation fee

- Courier fee

- Property tax escrow

- Prepaid interest

So how much are closing costs?

It’s difficult to provide a one-size-fits-all number because closing costs can vary significantly from one transaction to another. While you may often hear estimates of 2%–5% of the purchase price, many factors can push costs higher or lower.

- Bank fees alone can exceed 3% depending on your credit profile.

- Property tax rates can greatly impact your closing costs.

- Escrows for taxes and insurance are required by lenders and may require additional funds at closing, though they’re often refundable later.

What is the process of buying a home?

- Get Pre-Approved or Verify Funds – Before starting your search, ensure you have a loan pre-approval or sufficient funds.

- Find Properties – Identify the neighborhoods homes you’d like to explore.

- Choose Your Real Estate Agent – Select an agent to represent you and formalize the partnership with a signed buyer agency agreement.

- Schedule Showings – We’ll arrange property tours for you.

- Pricing Consultation – We provide expert insights on property values.

- Make an Offer – Once you find a home you love, we’ll help you prepare and submit a competitive offer.

- Negotiation – We negotiate with the seller on your behalf to secure the best terms.

- Confidentiality – Any information you share with us remains strictly confidential, forever.

- Offer Accepted! – You now have a contract.

- Earnest Money Payment – You’ll submit the earnest money deposit.

- Home Inspection – We’ll assist in arranging an inspection.

- Contract Review – We coordinate with your attorney to review the contract.

- Appraisal – We work with your lender to arrange the appraisal.

- Post-Inspection Negotiation – If needed, we negotiate further based on inspection findings.

- Loan Approval – Your mortgage gets the green light.

- Closing Date Set – We’ll guide you on what to prepare for closing.

- Final Walkthrough – We coordinate a last review of the property before closing.

- Closing Day! – You officially become a homeowner.

- Rebate Sent (If Applicable) – If a rebate was arranged, we’ll send it to you.

We’re here to guide you through every step of the process!

Can you just assist with the contract for a minimal fee?

There are two possible scenarios to consider:

Scenario 1: Full Representation (Required by Illinois and Indiana Law)

In both Illinois and Indiana, real estate agents are legally required to provide a minimum set of services when representing a client. This includes, but is not limited to:

- Accept delivery of, and present to the client offers and counteroffers

- Assist the client in developing, communicating, negotiating, and presenting offers, counteroffers, and notices

- Answer the client’s questions relating to the offers, counteroffers, notices, and contingencies

- Coordinate the transaction to closing

Because of these obligations, we cannot offer a service that only handles the contract—we must treat it like any other full transaction.

Scenario 2: Contract Consultation Only (Without Representation)

If you’re only looking for consultation on drafting a contract, we can provide guidance. However, in this scenario, we would not be representing you as an agent.

Key Considerations:

- Without a buyer’s agent, the seller’s agent keeps the full commission or may push to represent you as a dual agent, which could limit their ability to advocate fully for your best interests.

- You could try to negotiate directly with the seller’s agent to lower their commission, but in reality, we’ve rarely seen an agent willing to charge less than us while still providing quality service.

- Entering negotiations without a buyer’s agent often puts you at a disadvantage.

For Experienced Investors

If you are a highly experienced investor, we may be able to tailor a service that fits your needs. Please contact us directly to discuss your options.

Are there any hidden fees?

No, there are no hidden fees.

We don’t charge any upfront fees to work with us. However, to keep costs low, we limit the number of free showings. If you need more showings, we will provide a price quote during our meeting.

Won’t I save more by working directly with the seller’s agent?

No, for most of the times.

While it may seem like cutting out a buyer’s agent would reduce costs, the reality is more complex.

Scenario 1: Dual Agency

If the seller’s agent also represents you, you’ll still need to sign a buyer agency agreement and agree to a commission—just as you would with your own agent. The key difference is that the agent is now acting as a dual agent, meaning they represent both you and the seller. This creates a conflict of interest, legally limiting how much they can advocate for you.

Scenario 2: No Representation

If the seller’s agent does not represent you and only handles the paperwork, the seller will still pay a commission to their agent. This means you’re not actually saving money, but you’re also not receiving professional representation to protect your interests. Without an agent on your side, you may be at a disadvantage in negotiations and more exposed to potential risks.

Unless you are highly experienced in real estate transactions, working without your own representation is not recommended.

When is the best time to contact you? Should I reach out at the start of my home search?

We’re happy to provide consultation and recommendations at any stage of your home search.

That said, we recommend that you explore the market on your own first to gain confidence in what type of home suits your needs. This includes:

- Searching for homes online

- Attending open houses

- Driving through neighborhoods

- Getting loan pre-approval

Your preferences, financial situation, and family needs may evolve over time, which can impact the type of home you ultimately purchase. In fact, we’ve worked with many buyers whose criteria changed significantly from when they first started searching.

Also, keep in mind that we limit the number of complimentary showings, so having a clearer vision of your ideal home can help streamline the process and maximize your savings when you’re ready to move forward—ideally within a few months.

Will real estate agent's high or low commission rate or the rebate affect the home price?

No, our commission arrangement does not impact the home price—it only reduces your out-of-pocket costs.

The home price is determined by market conditions and negotiations between the buyer and seller. However, if you’re working within a tight budget, a lower commission or a sizable rebate can help ease your financial burden and make the purchase more affordable.

Fill the form to get started

Or directly email us at realexrealty@gmail.com

Due to our security measures, messages may occasionally be blocked unintentionally. If you do not receive a reply within 24 hours, please contact us directly at: realexrealty@gmail.com

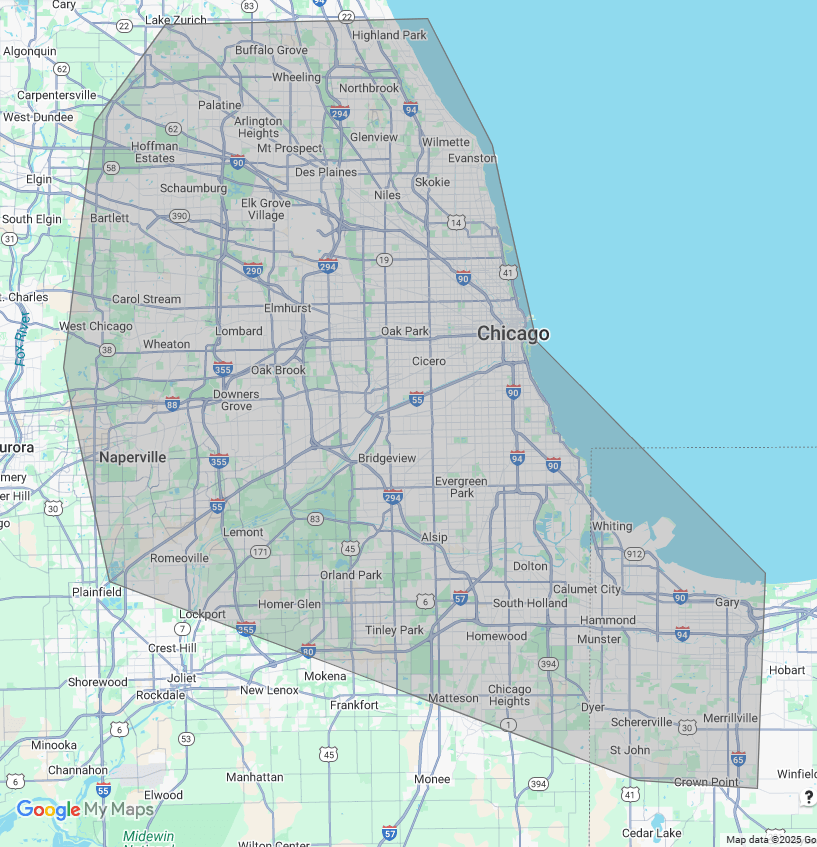

Service Area

We are licensed to sell properties throughout Illinois and Indiana. While we serve the entire region, our primary focus is on the Greater Chicago Area and communities in Northwest Indiana. Our main service areas include:

Illinois:

Wilmette, Northbrook, Schaumburg, Park Ridge, Hinsdale, Naperville, and other surrounding suburbs of Chicago.

Indiana:

Munster, Dyer, Schererville, St. John, and nearby towns in Northwest Indiana.